Description

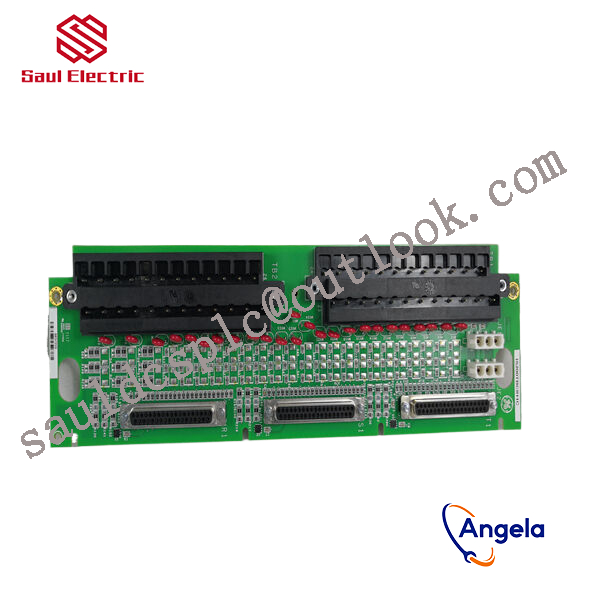

IS200TRTDH1CCC Product Introduction

The specific application scope of the product

will depend on the needs of system integration and industrial application, but generally speaking, this type of embedded controller module can be applied to the following categories:

manufacturing processes, etc.

monitoring and control system.

of the controller module, as well as the specific needs of the customer.

designed to manage gas or steam turbines.

It has a CIMPLICITY graphical interface and an HMI with software suitable for running heavy-duty turbines.

be installed at the bottom of the cabinet. For a small setup that is easy to serve a triple redundant system, up to three components can be installed side by side.

he board can operate within a temperature range of 0 to 65 degrees Celsius without the need for a fan for cooling. NFPA Class 1. This board can be used for two applications.

The growth rate of the industry”s overall net profit attributable to parent companies continues to decline, and the phenomenon of increasing industry revenue without increasing profits is obvious. In 2018, the industry as a whole achieved a net profit attributable to the parent company of 3.250 billion yuan, with a year-on-year growth rate of -26.42%. Although the overall revenue growth rate was positive in 2018, in the context of the fierce price war in the industry, increasing revenue does not increase profits. The phenomenon is very significant. In 2019Q1-3, the industry as a whole achieved net profit attributable to the parent company of 1.888 billion yuan, a year-on-year growth rate of -43.63%, and the growth rate of net profit attributable to the parent company continued to decline. Judging from the net profit attributable to the parent company of the industry in a single quarter, dragged down by the poor performance of New Star, the net profit attributable to the parent company of the industry in the single quarter of 2018 Q4 suffered a loss of 98 million yuan. The net profit performance of the industry attributable to the parent company has continued to be sluggish since 2019. . It is expected that the decline in the industry”s net profit attributable to the parent company for the whole year will narrow compared with the first three quarters, and the overall profitability will hit a historical bottom.The industry”s overall gross profit margin and net profit margin have continued to decline since 2017, and changes in gross profit margin and net profit margin in a single quarter are negatively correlated or related to the pace of corporate expense control. In 2019Q1-3, the overall gross profit margin of the industry was 28.68%, and the net profit margin was 5.54%. It has continued to decline since reaching a historical high in 2017, and the decline curve has gradually flattened. It is expected that the overall gross profit margin decline is expected to stabilize in 2020, and the net profit margin may be Ushering in upward repair. Judging from the changes in the industry”s overall gross profit margin and net profit margin in a single quarter, the two show a certain negative correlation. This may be due to the company”s reduction in gross profit margin due to fierce price wars or falling sales volume caused by the industry downturn. It is related to its own period expenses. On the contrary, when the gross profit margin rebounds, the company”s period expenses will increase to a certain extent.The industry”s overall operating cash flow has significant seasonal characteristics, and most sales collections are concentrated in Q4, which leads to an improvement in overall cash flow. In 2019Q1-3, the industry”s overall operating net cash flow was 580 million yuan, accounting for 1.52% of operating income. There is a big gap between this value and the whole year in previous years. Through the analysis of single-quarter data, it is found that the industry generally has negative operating net cash flow in the first quarter, and there will be a substantial inflow of operating net cash flow in the fourth quarter, thus driving the overall industry. Cash flow improved. China Merchants Bank Research Institute believes that this is mainly related to the industry”s payment methods. Most companies in the industry will advance capital investment after receiving orders at the beginning of the year, resulting in greater cash flow outflow. As the project settlement is gradually accepted and completed at the end of the year, payment collections are concentrated in the year. Tail release.5. A drop in short-term prosperity will not change the long-term growth trendIn 2018, global industrial robot sales reached 422,000 units, a year-on-year increase of 11.05%. IFR predicts that the sales growth rate in 2019 will reach -0.24%. In 2018, the total sales of industrial robots in my country was approximately 154,000 units, accounting for 36.49% of global sales. It is still the largest industrial robot market in the world.In 2018, the sales of industrial robots in my country reached US$5.4 billion, an increase of 21% over 2017. The decrease in sales volume but the increase in sales indicate that the average value of each industrial robot used in my country is increasing, and the products are gradually moving from low-end to mid-to-high-end. . From the perspective of industrial robot density, Singapore reached 831 units/ten thousand people in 2018, the highest in the world, followed by South Korea (774 units) and Germany (338 units). my country”s industrial robot density was 140 units/ten thousand people, higher than the world”s Average for each region (99 units).Compared with Singapore, South Korea, Germany and other developed countries in manufacturing automation, my country”s industrial robot sales still have a lot of room for improvement, and the long-term growth trend of the industry is clear. Through the overall third quarter report data of listed companies, we found that the overall industry revenue in 2019Q1-3 declined slightly year-on-year, and the negative growth in single-quarter revenue narrowed significantly; the growth rate of the industry’s net profit attributable to parent companies continued to decline, and the industry’s increase in revenue did not increase profits. The industry as a whole Operating cash flow has significant seasonal characteristics, and most sales collections are concentrated in Q4, which leads to an improvement in overall cash flow. Based on the previous macro data, it is believed that the fundamentals of the industry have hit the bottom, and the industry has structural differentiation characteristics. Looking forward to 2020, the negative impact of declining automobile sales on the demand for industrial robots will gradually weaken. The 3C field may contribute to the main increase in demand for industrial robots, and an industry turning point may be coming.

DS200PLIBG2ACA From General Electric in the United States

IS200ICIAH1ABB High performance processor module GE

IS200ERDDH1ABA From General Electric in the United States

DS200SHVMG1A I/O excitation redundant module GE

IS200VCMIH1B Gas turbine system Mark VI

IS200VCCCH1B High performance processor module GE

IS410STCIS2A I/O excitation redundant module GE

IS200VVIBH1B Gas turbine system Mark VI

IS210AEBIH1ADB Processor/Controller Mark VI System

DS3820PSCB1C1B From General Electric in the United States

DS200PCCAG7A High performance processor module GE

IS200BPIIH1A Gas turbine system Mark VI

IS215WEMAH1B High performance processor module GE

DS200TCQAG1B Gas turbine system Mark VI

IS230TDBTH6A GE power control board

IS220PPROH1A From General Electric in the United States

IS200DSPXH1D From General Electric in the United States

IS200TBCIH1B From General Electric in the United States

IS220PAOCH1A High performance processor module GE

IS200VCMIH2B GE power control board

IS200ESELH1AAA I/O excitation redundant module GE

IS200PSCDG1A GE power control board

IS215UCVEM08B High performance processor module GE

IS200ICBDH1ABB High performance processor module GE

DS200ACNAG1A Gas turbine system Mark VI

IS200TBAIH1C High performance processor module GE

IS200DSPXH1DBD Gas turbine system Mark VI

IS200ERGTH1AAA From General Electric in the United States

IS200IGPAG2AED Processor/Controller Mark VI System

IS220PAICH1A Gas turbine system Mark VI

IS420UCSCH2A GE power control board

IS420PUAAH1A I/O excitation redundant module GE

DS200TCDAG1PR5A High performance processor module GE

IS200RAPAG1A High performance processor module GE

IS200DAMDG1AAA I/O excitation redundant module GE

IS200EPSMG2ADC GE power control board

IS200HFPAG1A I/O excitation redundant module GE

IS420YDIAS1B I/O excitation redundant module GE

IS200RAPAG1A From General Electric in the United States

IS210AEAAH1B High performance processor module GE

IS210AEAAH1B Gas turbine system Mark VI

DS200SLCCG4A High performance processor module GE

DS200ADMAH1A High performance processor module GE

IS215UCVEM01A High performance processor module GE

IS210MACCH2A High performance processor module GE

IS410JPDHG1A High performance processor module GE

IS215VCMIH2BB From General Electric in the United States

IS220PDIOH1B High performance processor module GE

GDS1168-PFF-PA-NF From General Electric in the United States

IS200IGDMH1AAA Processor/Controller Mark VI System

IS200TVIBH2B Gas turbine system Mark VI

IS220PSCAH1A Gas turbine system Mark VI

IS220PPDAH1A High performance processor module GE

IS420USBH1A I/O excitation redundant module GE

IS410STCIS2A GE power control board

IS200STCIH6AED Processor/Controller Mark VI System

IS200VTURH2BAC Processor/Controller Mark VI System

IS200VRTDH1B Processor/Controller Mark VI System

IS200SRTDH2ACB GE power control board

IS215AEPCH1C Processor/Controller Mark VI System

IS220PAOCH1A Gas turbine system Mark VI

DS200DTBDG1ABB GE power control board

IS420UCSCH1B Gas turbine system Mark VI

DS200PLIBG1ACA High performance processor module GE

IS200SSBAG1A GE power control board

IS200STAOH2AAA GE power control board